An ITF36 is printed at the same time as P6's for employees that have earned income but not paid tax, those under the threshold or on directive. It is similar in form and layout to a P6. They are issued, instead of a P6, to employees that earned income during the year but did not pay PAYE. This could happen when the employee is on a tax directive, or their income did not bring them into a tax band.

This is used less than in the past. With the introduction of FDS tax calculations employees that have not had PAYE amounts deducted would have their income details submitted on the ITF16 regardless. There is, therefore, less of a need to use the ITF36 for this purpose.

An ITF36 is similar in form and layout to a P6. They are issued, instead of a P6, to employees that earned income during the year but did not pay PAYE. This could happen when the employee is on a tax directive, or their income did not bring them into a tax band.

In the past employees would submit this form together with their annual tax return. Under the FDS system it assumes a different purpose, being a certification of amounts earned during the tax period.

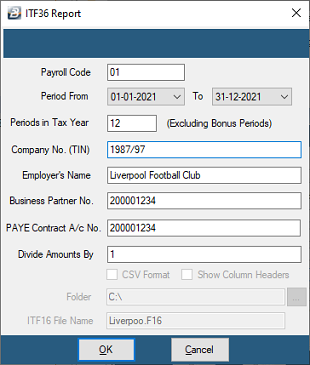

To print an ITF 36:

•Go to the 'View', then 'Tax' menu options.

•Select the 'ITF36 [No PAYE]' menu option,

•Enter the Payroll Code - If there is only one payroll enter '01'.

•Press 'OK'

•Use the range selection screen to select the employee/s required

•Select 'Print'.